The 25-Second Trick For Spotminders

Wiki Article

Spotminders - Truths

Table of ContentsSome Ideas on Spotminders You Need To KnowGet This Report on SpotmindersOur Spotminders DiariesAn Unbiased View of Spotminders10 Simple Techniques For SpotmindersSpotminders Things To Know Before You Buy

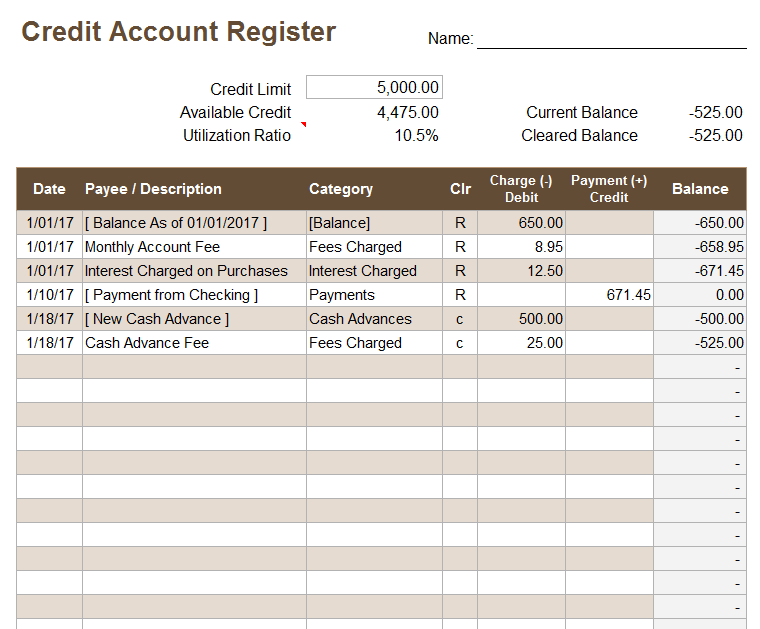

Day card was very first opened Credit line you were accepted for. This elements heavily into Credit rating questions remain on your debt report for 2 years. This influences your credit history, and service cards are not included How much time you've had the charge card for and factors into your credit rating's estimation The yearly charge associated with the bank card.

Feel totally free to change Utilizes solutions to computer the amount of days are left for you to hit your minimum spendUses the bonus and amount of time columnsB When you obtained your benefit. There is conditional formatting here that will transform the cell environment-friendly when you input a day. Whether the card charges fees when making foreign purchases.

It's important to track canceled cards. Not just will this be a good scale for my credit history rating, yet numerous credit score card bonus offers reset after.

Spotminders for Beginners

Chase is without a doubt one of the most stringiest with their 5/24 guideline yet AMEX, Citi, Funding One, all have their very own set of rules as well (car tracker) (https://form.typeform.com/to/FsiWVoeF). I've produced a box on the "Present Inventory" tab that tracks the most common and concrete rules when it comes to churning. These are all made with formulas and conditional formatting

Are you tired of missing out on possible savings and bank card promos? If so, this CardPointers testimonial is for you. If you desire to, this app is a game-changer! Before I discovered, I usually scrambled to select the right charge card at checkout. For many years as the variety of cards in my purse expanded, I had problem with monitoring all my offers.

Not known Details About Spotminders

Eventually, I wisened up and started jotting down which cards to utilize for day-to-day acquisitions like dining, grocery stores, and paying details costs - https://go.bubbl.us/ec0e5e/e6c4?/New-Mind-Map. My system had not been perfect, but it was much better than nothing. CardPointers came along and altered just how I managed my credit score cards on the go, supplying a much-needed solution to my problem.Which card should I make use of for this purchase? Am I missing out on out on extra advantages or credit reports? Which credit score card is really providing me the best return?

It helps in choosing the ideal credit score card at check out and tracks offers and benefits. phone tracker,. Just recently included as Apple's Application of the Day (May 2025), CardPointers assists me answer the vital question: Offered on Android and iOS (iPad and Apple Watch) tools, along with Chrome and Safari internet browser expansions, it can be accessed any place you are

Little Known Facts About Spotminders.

In the ever-changing globe of factors and miles supplies come to be outdated promptly. CardPointers maintains us arranged with details concerning all our credit rating cards and aids us rapidly decide which cards to make use of for every acquisition.Just in case you forgot card advantages, search for any card details. CardPointers' user-friendly user interface, along with shortcuts, custom-made sights, and widgets, makes browsing the application very easy.

The Greatest Guide To Spotminders

Failing to remember a card could be an obvious dead spot, so audit your in-app charge card profile twice a year and include your newest cards as quickly as you have actually been approved. This means, you're always as much as day. CardPointers sets you back $50 a year (Normal: $72) or $168 for lifetime gain access to (Regular: $240).CardPointers supplies a complimentary version and a paid version called CardPointers+. The complimentary tier consists of fundamental features, such as including credit report cards (limited to one of each kind), seeing offers, discover here and choosing the ideal credit rating cards based on details acquisitions.

Get This Report on Spotminders

Also this opt-out alternative is not available for consumers to stop bank card companies and providing financial institutions from sharing this information with their financial affiliates and financial "joint marketers," a vaguely specified term that gives a large loophole secretive securities. Nor do consumers obtain the transparency they should regarding exactly how their info is being shared.When the reporter Kashmir Hill attempted to find out what was being performed with her Amazon/Chase bank card data, both firms primarily stonewalled her. The impossible number of click-through agreements we're overloaded by online makes these notifications simply component of a wave of small print and also much less significant. In 2002, people in states around the nation started to rebel versus this regulation by passing their very own, tougher "opt-in" monetary privacy policies calling for individuals's affirmative authorization prior to their info can be shared.

Report this wiki page